.

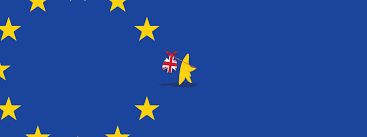

In 2023, Brexit will have a big impact on how international businesses operate. Get ahead of the game and stay informed – don’t let uncertainty affect your success!

Despite countless debates and sketchy evidence, Brexit has not yet been successfully or unsuccessfully announced. Only the low-hanging fruit of conventional Free Trade Agreements with New Zealand and Australia are available to those who would look to trade agreements and autonomous regulatory policies as indicators of success. On the other hand, given what was always going to be an economic shock, the evidence of export challenges relative to other European countries is as of now far from conclusive.

More data on Brexit’s performance will become available in the coming year, especially in light of three key trade policy issues:

- Ratifying the Comprehensive and Progressive Agreement for the Trans-Pacific Partnership (CPTPP), considering its interdependence with the Northern Ireland Protocol’s implementation;

- Striking a successful Free Trade Agreement with India’s infamously frugal negotiators;

- Maneuvering a failing global trade system that threatens to leave the UK stranded.

- If the UK is successful in these, its international standing will appear much stronger and more secure. In part because doing so would require opposing the elements of the Conservative Party that have most vehemently supported Brexit.

The UK was originally scheduled to join CPTPP and sign an FTA with India in 2022 under the leadership of Prime Minister Boris Johnson. Although delays in trade policy are quite common, it is more concerning when the causes are not disclosed.

India is the easier country to understand. Although the fundamental chapters have been finished, no one with knowledge of either country is surprised by India’s alleged limited market access offers or the UK’s continued mobility issues. The main concern for the UK government is whether a modest improvement in market conditions for UK businesses will be politically acceptable, especially in light of the perception that the government failed to advance its interests in the Australia Free Trade Agreement.

There are valid arguments in favour of a modest ambition agreement as a first step towards something better or as a step up from what other countries, like the EU, have accomplished. However, the UK government has refrained from doing so thus far, likely out of concern that it might weaken their bargaining position or support. This appears to be an error that needs to be fixed right away because the presentation of this FTA will be the true test given that the substance will unavoidably fall short of commercial demands.

The CPTPP accession process is more complicated, and a geopolitical issue involving China’s application and the Northern Ireland Protocol is more problematic than the challenge of satisfying existing members’ expectations of the same level of UK liberalisation as per the deals with Australia and New Zealand. The basic idea behind this binary argument, which has nothing to do with market access, is that if the UK joins while threatening to renegotiate its own treaty with the EU, CPTPP members will be unable to use China’s breach of trade agreement commitments as justification for not moving forward with accession talks. Therefore, the UK must reach a compromise while still making it acceptable to hardline Conservative MPs and unionists in Northern Ireland. The improvement of EU relations will be a significant side benefit.

The UK’s acceptance that its trade choices are constrained is put to the test by its CPTPP membership, something that Brexit supporters may not understand as well as those versed in the realpolitik of trade discussions. Given that the UK will eventually have tighter ties to the EU than they have today due to geography and popular opinion, this may just be a matter of time. If this occurs in 2023 as a result of CPTPP membership, it will be an indication that the UK is beginning to regain some stability and that the Conservative Party, in particular, is beginning to show some moderation.

Nothing else will even come near to this level of significance for UK trade policy in 2023; in contrast, other discussions to revise current agreements with countries like Israel and South Korea will be mostly irrelevant. The UK government has acknowledged the need for trade policy beyond FTAs, albeit it is not yet clear what exactly that would entail.

Developing a trading strategy for a world in transition

One of the main ideas behind Brexit was that the US and UK would work together to defend their version of free trade in opposition to that of the EU. This idea was developed between some Conservatives and their US Republican counterparts in the years leading up to the referendum. This was the low-regulation Singapore-on-the-Thames concept, which, despite the fact that it may never have been feasible and was less popular with voters than the notion of limiting immigration, continued to hold significant power among Brexit leaders.

Presidents Trump and Biden have cast doubt on this idea by escalating the US’s propensity for protectionism and flouting international law, making it difficult for UK Ministers to travel to Washington, DC on a regular basis to discuss shared values like free trade. However, this is arguably less difficult to answer than the question of what would happen to medium powers like the UK if global norms are no longer upheld, especially by China, the US, and the EU. Due to recent problems brought on by budget constraints and the triumph of ideology over traditional diplomacy, the UK’s relations with all of the big powers as well as many of the mid-level ones are currently fragile.

Regarding the UK’s underlying ideals of general support for free trade and the rule of law, it should be relatively simple to at least develop a modern vision and engage with partners on this. This should combine with the growing emphasis for fighting climate change. However, Brexit politics make some things more difficult, such as collaborating with the EU, proposing significant trade and climate change policies, or defying the US by joining the temporary WTO appellate body replacement.

Lack of comprehension has also been a problem, especially when it comes to how commerce and regulations interact, which has the unavoidable consequence of making the UK uncomfortable as a rule-taker given that the Brexit referendum was won on the premise of regaining control. Regulations must be stable in order to attract profitable new inward investment, but if this necessitates abiding by EU regulations, there is a dilemma that is still hardly ever mentioned in the UK.

Conclusion

Independent trade policy is frequently cited as a major Brexit advantage. The meagre benefits and challenges in delivering them have long alarmed trade experts, making that claim questionable. If the UK joins the CPTPP in 2023, settles the Northern Ireland Protocol dispute, improving EU ties, and completes an India FTA that is generally regarded as acceptable, it will be a huge political accomplishment by any standard. The return of UK political stability will be a counterweight to the economic costs of a looser trading relationship with the EU, especially if it also entails a better knowledge of regulatory realities.

Far from being ended, the Brexit story will continue to be significant in 2023.