“Discover the intricate implications of market coupling in the power sector, from its impact on investments and current shareholders to international comparisons and innovation. Uncover how regulatory shifts may dampen investments, destabilize share prices, and influence the global landscape. Learn how market coupling could potentially hinder innovation critical for grid efficiency and sustainable energy adoption.”

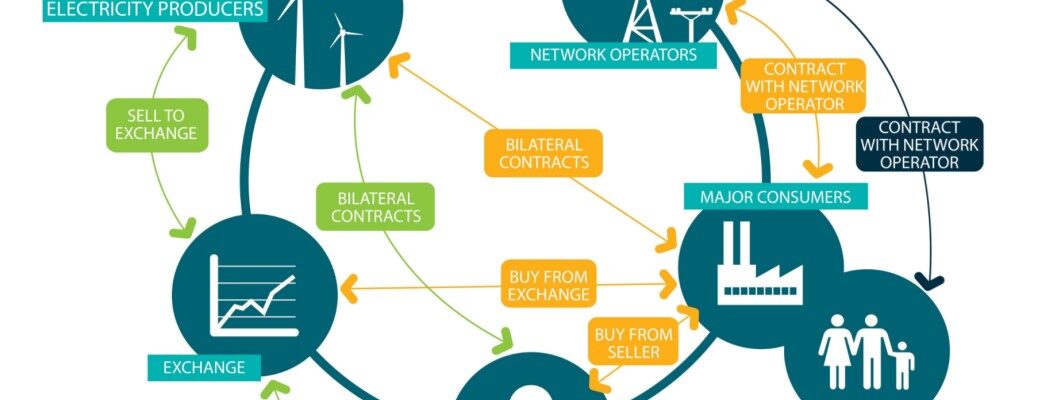

The power sector stands as the cornerstone of economic development, attracting significant investments and serving as an essential public utility. The recent discussions surrounding market coupling in the power sector have stirred concerns regarding its potential ramifications on investments, current shareholders, international comparisons, and innovation within the industry. In this blog, we explore the multifaceted implications of market coupling on various aspects of the power sector.

- Dampening Investments in the Power Sector

Market coupling introduces a disruptive element to the established business model of Power Exchanges, potentially deterring potential investors. The uncertainty and regulatory risks associated with this change can be particularly discouraging in sectors requiring substantial capital investments. The power sector often necessitates long-term financial commitments and substantial capital infusion, making it vulnerable to any abrupt regulatory shifts. Such changes can jeopardize the stability investors seek, potentially dampening investments and impeding the sector’s growth.

- Impact on Current Shareholders

Market coupling fundamentally alters the concept of price discovery, a vital function in Power Exchanges. As a result, share prices may experience significant reductions, affecting the savings and investments of individual shareholders. This shift can create market instability and erode investor trust, potentially disrupting the flow of capital.

- International Experience

Examining global exchange markets provides valuable insights into the potential consequences of market coupling. Network effects play a crucial role in the competitive landscape of exchanges. For instance, the New York Stock Exchange (NYSE) remains a global leader with strategic investments, market simplification, and operational streamlining that bolster investor confidence and listed company positions.

Similarly, other exchanges have solidified their niches and command leadership in specific market segments, such as the London Metal Exchange and Tokyo Commodity Exchange. In India, the National Stock Exchange (NSE) has a significant share of equity cash trading volumes, while MCX dominates the commodity derivatives market. These international experiences highlight the potential effects of market coupling on exchange dynamics.

- Impact on Innovation

Market coupling may lead to exchanges losing their ability to levy transaction fees, potentially diminishing their incentive to stimulate participation for efficient price discovery. The centralization of bid-matching platforms beyond private enterprise could hinder innovation in the industry, which is crucial for enhancing grid efficiency and promoting sustainable energy sources. Restricting innovation could impact the development of innovative products that support grid efficiency and participation.

Market coupling in the power sector has far-reaching implications that touch on investments, shareholders, international comparisons, and innovation. It introduces uncertainty, potentially discouraging investors and affecting share prices. Examining international experiences provides insights into potential market dynamics, and the impact on innovation is a concern for grid efficiency and sustainability. As market coupling continues to evolve, stakeholders must carefully consider its effects on the power sector’s growth and development.